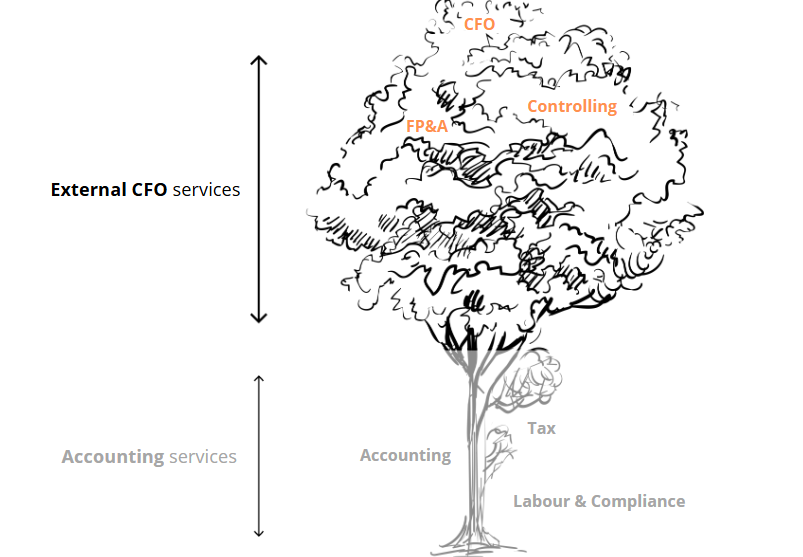

Our External CFO service is tailored to the specific stage, industry, and needs of every company we work with, from pre-seed ventures to growth-stage businesses across different countries and sectors.

We cover the three pillars of high-impact financial management: Strategic leadership (CFO), forward-looking planning (FP&A), and operational control (Controlling). Whether it’s fundraising, financial modeling, reporting, or process optimization, we adapt our support to what your business truly needs.

More than just consultants, we integrate as part of your team, bringing financial clarity, execution, and long-term strategy. With a proven track record and deep expertise, we help you focus on your business while we structure, plan, and lead your finance function.

Maintain financial models aligned with business goals.

Run "what-if" scenarios to support strategic decision-making under different growth or cost conditions.

Analyze performance and identify improvement opportunitiess.

Track KPI’s and align with strategic targets.

Control budgets and monitor spending.

Forecast revenue, expenses, and cash flow.

Prepare financial insights for investors and leadership.

Support planning with real-time financial data.

Update models to reflect strategy and change.

If you think we can help you take the financial and strategic management of your company to the next level, send us a message. We will get back to you as soon as possible to meet and discuss how we can help you.

Prefer e-mail? hello@ebs.qa