Our external CFO service

Our comprehensive external CFO service encompasses the three critical financial facets essential to every Startup’s success: financial control, streamlined processes and effective fundraising strategies. We consistently bring our extensive knowledge, experience and unwavering commitment to each and every one of our valued clients. With our external CFO service we want you to invest your time in what you do best, your project.

Do you want to know about our external CFO service?

We provide financial expertise and strategic business support to high-growth companies.

With our external CFO service we want to ensure the proper control and financing of entrepreneurs, helping them to improve the world through innovation and job creation.

Our working method

Understand

We invest time in thoroughly understanding the project, its current or future business segments and the intricacies of the company’s organizational structure. At the same time, we diligently gather all essential information to ensure a smooth and productive start to our collaborative efforts from day one.

Support

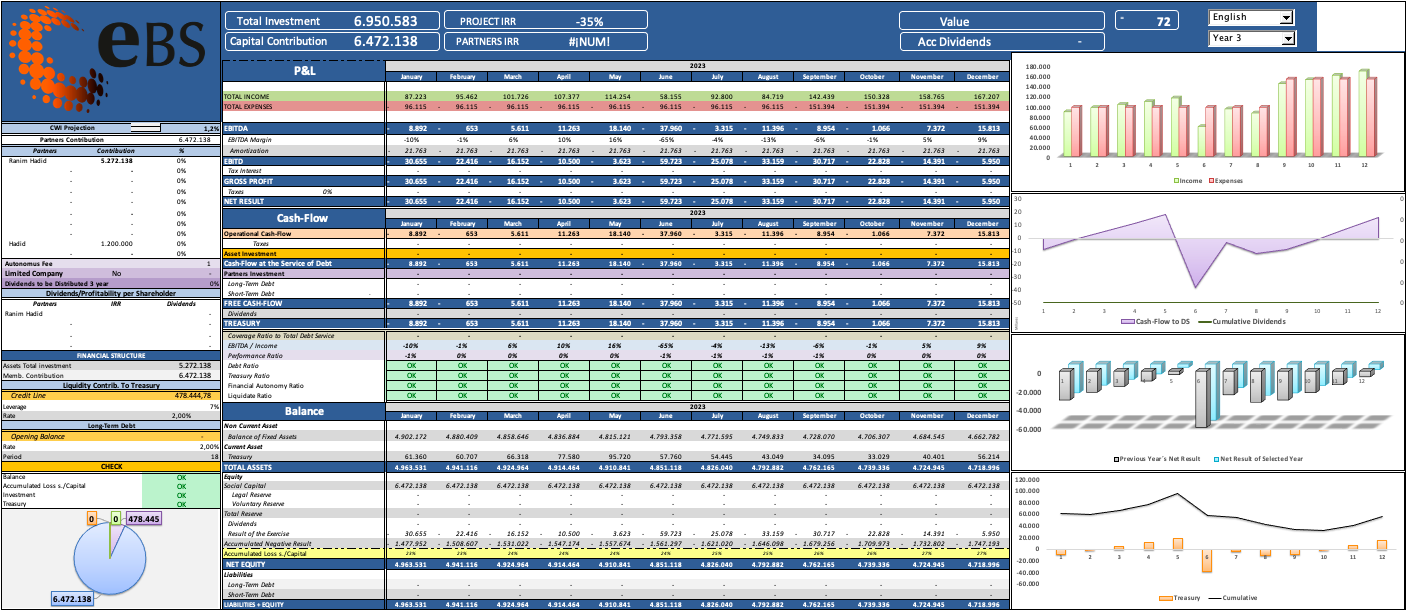

We build the business model, including monthly reporting and forecasting, focusing in detail on three fundamental aspects: KPIs to analyze the company’s performance, P&L to evaluate the financial health and cash flow to know how far we can go.

Tailor – Made

We adapt our services to solve the main problems of each startup we work with. We integrate ourselves as a member of the team to solve the specific needs of the project.

1. Control

We monitor and provide strategic guidance to your startup through the forecasting process, diligent monitoring of key performance indicators (KPIs) and meticulous data analysis

Business Planning

✔ We developed a new business plan based on reliable but ambitious estimates and focused on key business metrics.

✔ We integrate the company’s financial targets and key performance indicators with operational objectives.

✔ Provided key insights on growth drivers, employees and expenses.

Forecasting

✔ Constantly maintain up-to-date forecasts on KPIs, financials and cash flows to ensure that estimated targets are achieved.

✔ We show realistic future results and outlooks that guide startups to maximize growth.

✔ We ensure that current funds cover future needs to minimize risk.

Reporting

✔ Share knowledge and data with the clients, so that they can know in advance the consequences of their decisions and strategies.

✔ Propose actions and improvements in both business and economic aspects.

✔ We summarize key insights and warning signals for investors and management teams.

2. Process

We are responsible for the smooth running of the administrative management of the Startup

Admin

✔ We create and scale the financial accounting system (invoicing, collections, payments and accounting processes).

✔ We optimize treasury and currency management.

✔ We structure the finance department and its functions.

Analysis

✔ We implement dashboards for budget control and KPI tracking.

✔ We build financial models for the study of scenarios before any business decision.

✔ Strategic analysis of prices and costs.

3. Fundraising

We actively support our entrepreneurs in meeting their financial needs.

Banking

✔ Analyze the company’s needs in order to improve its capital structure.

✔ We support applications with company forecast.

✔ Carry out the application process with banks on behalf of the company.

Private

✔ We prepare all the necessary information for private financing rounds related to business plan, valuation or cap table.

✔ We provide all necessary documentation to potential investors.

✔ We support in the preparation of other materials and negotiations.

The value we bring

You may have asked yourself some of the questions we answer below. At EBS we work to give you the answer to the problems that arise in the financial management of your startup

Do you think you should be taking care of financial & administrative tasks of your startup?

How can you help my business improve its financial performance and profitability?

What are the key financial metrics I should be monitoring for my business?

Can you assist with budgeting and forecasting for my business?

Need a CFO for your startup but can’t afford a senior profile?

Have you received financing and need support from your investors?

How can you help manage cash flow and ensure the business has enough liquidity?

Do you think you are making the right financial decisions on time?

What financial reports and analysis will you provide regularly?

Does your accountant provide you with the financial solution you need?

Can you help with financial risk management and compliance with regulations?

How will you tailor your services to my specific industry and business needs?

Do you offer assistance with fundraising or securing financing for my business?

What are the benefits of the external CFO services as opposed to hiring an in-house CFO?

How can I get started with your external CFO services, and what is the cost structure?

Contact with us

If you think we can help you take the financial and strategic management of your startup to the next level, send us a message. We will get back to you as soon as possible to meet and discuss how we can help you.