In the dynamic landscape of small and medium-sized enterprises (SMEs) and startups, effective financial management is paramount to success. Among the key figures driving financial strategies and decision-making, the Chief Financial Officer (CFO) plays a pivotal role. Despite the misconception that CFOs are primarily associated with large corporations, their importance is equally pronounced in SMEs and startups. In this article, we delve into the significance of the CFO in SMEs and startups, explore how their strategic financial guidance can be a game-changer for success, and discuss the merits of outsourcing CFO services for SMEs and startups.

What is a CFO?

A CFO, or Chief Financial Officer, is a high-ranking executive responsible for managing the financial actions of a company. This role is crucial in overseeing the financial planning and record-keeping, as well as ensuring the financial stability and growth of the organization. The CFO reports to the CEO (Chief Executive Officer) or board of directors and is often a key participant in strategic planning and decision-making.

Responsibilities of the Chief Financial Officer (CFO)

Financial Strategy and Planning

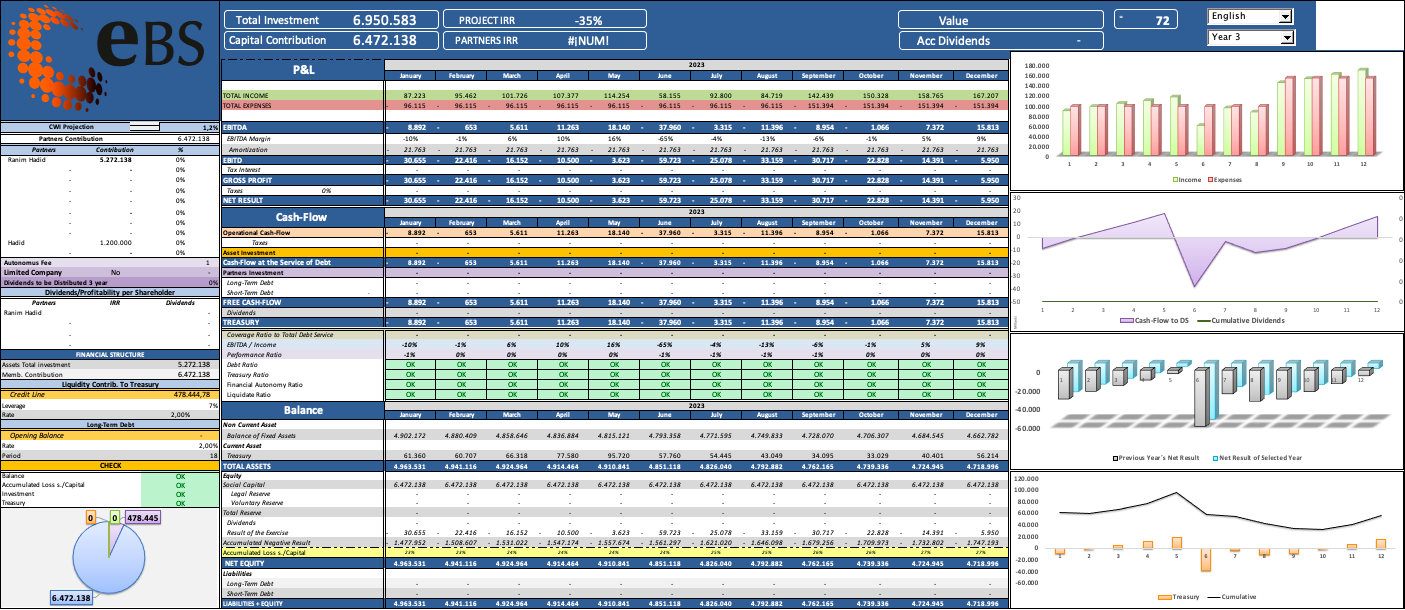

One of the primary responsibilities of a CFO is to develop and implement robust financial strategies. In SMEs and startups, where resources are often limited, strategic financial planning becomes a lifeline. CFOs analyze market trends, assess risks, and create financial roadmaps that align with the company’s objectives. Their insights help in making informed decisions, optimizing resource allocation, and ensuring long-term sustainability.

Risk Management

SMEs and startups are inherently more susceptible to financial risks due to their size and relative lack of resources. The CFO serves as the financial watchdog, identifying potential risks and implementing risk mitigation strategies. This includes assessing credit risks, market fluctuations, and operational vulnerabilities. By proactively managing risks, CFOs contribute to the stability and resilience of the business.

Fundraising and Capital Allocation

For startups, securing initial funding is a crucial step, and for SMEs, efficient capital allocation is vital for growth. CFOs are instrumental in fundraising efforts, presenting financial data in a compelling manner to attract investors. Additionally, they play a key role in determining the optimal use of capital, whether it’s for expanding operations, research and development, or marketing initiatives. Their ability to balance short-term needs with long-term goals is invaluable for sustained growth.

Financial Reporting and Compliance

In the ever-evolving regulatory landscape, CFOs play a critical role in ensuring that SMEs and startups comply with financial reporting requirements. From tax compliance to financial audits, CFOs guarantee that the company adheres to legal standards. Accurate and transparent financial reporting not only satisfies regulatory bodies but also enhances the company’s credibility with stakeholders, fostering trust and confidence.

Technology Adoption

In the age of digital transformation, CFOs are at the forefront of adopting financial technologies that streamline processes and enhance efficiency. For SMEs and startups, where agility is key, leveraging fintech solutions can significantly improve financial management. Whether it’s implementing cloud-based accounting systems or utilizing data analytics for informed decision-making, CFOs play a pivotal role in driving technological advancements in financial operations.

Why is it Important to Have a CFO?

The importance of having a Chief Financial Officer (CFO) in small and medium-sized enterprises (SMEs) and startups cannot be overstated, as their role goes far beyond traditional financial management. Here are key reasons highlighting the significance of having a dedicated CFO:

- Strategic Decision-Making: CFOs are strategic partners who provide insights that go beyond numbers. They contribute to informed decision-making by assessing financial implications, identifying growth opportunities, and aligning financial strategies with overall business objectives.

- Financial Stability and Risk Management: The CFO plays a pivotal role in maintaining financial stability by managing risks effectively. Their expertise allows them to foresee potential financial pitfalls, implement risk mitigation strategies, and navigate the complexities of the business landscape.

- Investor Confidence: In startups, where attracting investors is crucial for initial funding, having a CFO enhances the credibility of financial information. Investors are more likely to invest when they see a well-structured financial strategy and transparent reporting, both of which are areas where CFOs excel.

- Operational Efficiency: CFOs streamline financial processes, leveraging technology and best practices to enhance operational efficiency. This efficiency is particularly crucial for SMEs and startups where resources are limited, making every financial decision impactful.

- Compliance and Governance: CFOs ensure that the company adheres to financial regulations and governance standards. Their expertise in compliance not only protects the company from legal repercussions but also fosters a culture of accountability and transparency.

- Long-Term Planning: CFOs are instrumental in developing long-term financial plans. In SMEs and startups, where survival and growth are closely linked to effective planning, having a CFO who can guide the company through different growth stages is indispensable.

Why Outsource CFO Services for SMEs and Startups?

While having an in-house CFO is ideal, the financial constraints and evolving nature of SMEs and startups often make outsourcing CFO services a practical and strategic choice. Here’s why:

- Cost Efficiency: Hiring a full-time CFO can be financially challenging for SMEs and startups. Outsourcing CFO services allows these businesses to access high-level financial expertise without the hefty salary and benefit packages associated with a full-time executive.

- Flexibility: The financial needs of SMEs and startups can vary over time. Outsourcing CFO services provides the flexibility to scale up or down based on the company’s financial requirements. This adaptability is particularly valuable in the unpredictable early stages of a business.

- Access to Specialized Expertise: Outsourced CFOs often bring a wealth of experience from working with various businesses. This diverse background enables them to offer specialized expertise and innovative solutions that may not be readily available with an in-house CFO.

- Focus on Core Competencies: SMEs and startups benefit from focusing on their core competencies. By outsourcing CFO services, the internal team can concentrate on driving the business forward, leaving complex financial management in the hands of experts.

- Reduced Recruitment Time: Recruiting a full-time CFO is a time-consuming process. Outsourcing allows businesses to quickly access the skills and knowledge they need without the delays associated with hiring processes.

Conclusion

In conclusion, while having a CFO is essential for SMEs and startups, outsourcing CFO services provides a pragmatic solution that combines financial expertise with cost-effectiveness and flexibility. It enables these businesses to navigate the intricate financial landscape with confidence, positioning them for sustainable growth and long-term success.

At Encircle Business Solutions, it is clear to us that in today’s startup business world, a full-time CFO is not always a necessity, nor is it always a financial possibility. Instead, startups can explore more flexible and affordable solutions to manage their finances and make sure they grow in a solid and sustainable way, in this context it is worth mentioning our work.

From Encircle Business Solutions we want to offer you our external CFO service, we take care of your financial department, so you can fully dedicate yourself to your project, visit our website and check all our services!

Una respuesta a «The Crucial Role of the CFO in SMEs and Startups»

Los comentarios están cerrados.