Startups operate in a dynamic and fast-paced environment, where success is often measured by agility, innovation, and effective decision-making. To thrive in this competitive landscape, entrepreneurs must leverage Key Performance Indicators (KPIs) to assess their business’s health and performance. In this article, we will explore essential KPIs for startups, how to read them, and the methods to calculate them.

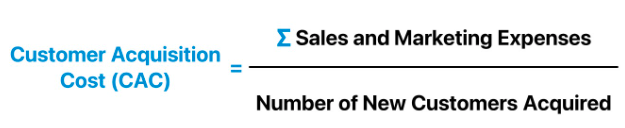

Customer Acquisition Cost (CAC)

CAC measures the cost incurred to acquire a new customer. To calculate CAC, divide your total marketing and sales expenses by the number of new customers gained within a specific period. A lower CAC suggests a more efficient customer acquisition strategy.

CAC is crucial for startups as it provides insights into the efficiency of their customer acquisition strategies. By understanding the cost involved in acquiring new customers, startups can allocate resources more effectively and refine their marketing and sales approaches to improve efficiency.

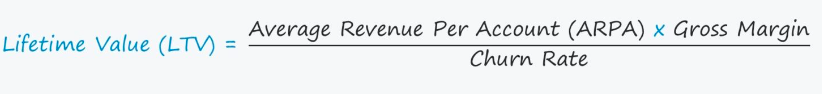

Lifetime value (LTV)

The Customer Lifetime Value (LTV) Ratio is a crucial metric for startups to assess the long-term value a customer brings to the business. It is calculated by multiplying the average value of a customer’s purchase by the average number of transactions per year and the average retention time. This metric helps in understanding the return on investment over the entire customer lifecycle.

A high LTV ratio indicates that the revenue generated from a customer is significantly higher than the cost of acquiring and retaining that customer. This helps startups make informed decisions about customer acquisition budgets, marketing strategies, and overall business sustainability. By increasing the LTV ratio, startups can enhance profitability and focus on acquiring customers with higher long-term value.

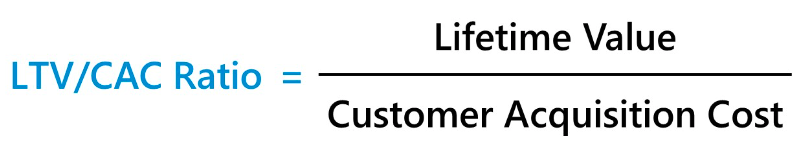

LTV/CAC

The LTV/CAC Ratio measures the relationship between the lifetime value of a customer and the cost incurred to acquire that customer.

The customer lifetime value (LTV) refers to the profit brought in by a customer, while the customer acquisition cost (CAC) is the expense incurred in convincing the customer to purchase the product.

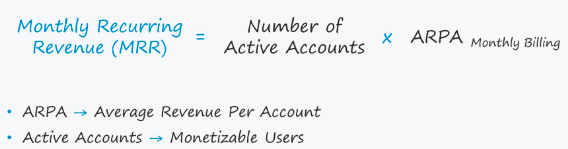

Monthly Recurring Revenue (MRR)

MRR reflects the predictable and recurring revenue generated by a startup each month. This is especially relevant for subscription-based business models. To calculate MRR, multiply the average revenue per user (ARPU) by the total number of subscribers.

MRR is particularly relevant for subscription-based startups. It helps in forecasting and planning by providing a predictable revenue stream. Startups can use MRR to assess the success of customer retention efforts and adjust pricing strategies to maximize recurring revenue.

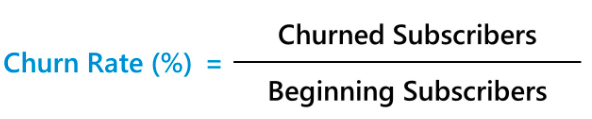

Churn Rate

Churn rate measures the percentage of customers who stop using a product or service over a given period. A high churn rate can indicate dissatisfaction or issues with the product. To calculate churn rate, divide the number of customers lost during a specific period by the total number of customers at the beginning of that period.

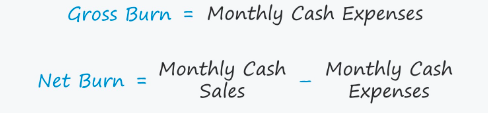

Burn Rate

Burn rate represents the rate at which a startup is spending its capital. It is crucial for understanding how long the business can sustain its operations before needing additional funding. To calculate burn rate, subtract the total expenses from the total revenue.

Burn Rate is essential for managing cash flow. It helps startups understand how quickly they are spending their capital, allowing for better financial planning. By monitoring the Burn Rate, startups can make informed decisions about when to seek additional funding or adjust spending to extend their runway.

Gross and Net Profit Margins

Gross profit margin is the percentage of revenue that exceeds the cost of goods sold (COGS). Net profit margin considers all expenses, including operating costs, taxes, and interest. Both margins provide insights into a startup’s profitability.

Profit margins are fundamental for assessing overall financial health. Gross Profit Margin helps startups understand the profitability of their core business activities, while Net Profit Margin considers all expenses. Startups can use these margins to identify areas for cost optimization and ensure sustainable profitability.

Monthly Active Users (MAU) and Daily Active Users (DAU)

For startups with digital products, tracking MAU and DAU is vital. MAU measures the number of unique users engaging with the product monthly, while DAU measures daily engagement. These metrics help gauge user retention and overall product popularity.

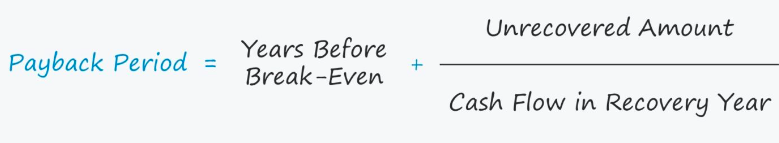

Payback

KPI Payback measures the time it takes to recover the cost of acquiring a new customer through the revenue generated from that customer.

- Shorter Duration → As a general rule of thumb, the shorter the payback period, the more attractive the investment, and the better off the company would be – which is because the sooner the break-even point has been met, the more likely additional profits are to follow (or at the very least, the risk of losing capital on the project is significantly reduced).

- Longer Duration → A longer payback time, on the other hand, suggests that the invested capital is going to be tied up for a long period – thus, the project is illiquid and the probability of there being comparatively more profitable projects with quicker recoveries of the initial outflow is far greater.

Rolling Fund

Rolling Fund helps startups assess the continuity of their funds. By monitoring the inflow and outflow of capital over a specific period, startups can identify trends and plan for potential funding gaps. This KPI is crucial for maintaining financial stability and avoiding cash flow crises.

In the challenging landscape of startups, effective measurement and analysis of KPIs are essential for making informed decisions and steering the business toward success. By regularly monitoring and interpreting these key indicators, entrepreneurs can adapt strategies, allocate resources wisely, and foster sustainable growth. Remember, KPIs are not one-size-fits-all; customize them based on your startup’s unique goals and business model.

As you can see, KPIs play a critical role in success and profitability, as they provide valuable information about your financial health and operational efficiency. If you’re looking to maximise your startup’s performance and have the backing of financial experts, consider hiring an external CFO. At EBS, we have a highly trained and experienced team to help you achieve your business goals, optimise your financial resources and take your company to the next level.