In the annals of business history, the pivotal roles of the Chief Executive Officer (CEO) and Chief Financial Officer (CFO) have been foundational to the decision-making processes and triumphs of organizations.

What renders this alliance truly influential is the symbiosis between these leadership roles; the seamless collaboration between the CEO and CFO is not merely advantageous but has evolved into a pivotal determinant for the enduring success of any enterprise.

CEO Duties

The CEO, or chief executive officer, assumes the mantle of top leadership within a company, wielding substantial influence over its trajectory. Primary responsibilities encompass:

- Strategic vision: The CEO shoulders the responsibility of crafting the vision and strategic trajectory of the company. Decisions on the mission, objectives, and long-term strategy rest on their shoulders.

- Risk oversight: While the CFO is pivotal in financial management, the CEO must also grasp and navigate business risks at a strategic level.

- Corporate representation: Serving as the public face of the company, the CEO engages with shareholders, investors, customers, and key stakeholders, with the onus of upholding and enhancing the organization’s reputation.

- Leadership and decision-making process: Steering executive teams and making pivotal decisions for the business falls under the CEO’s purview. They oversee strategy implementation, ensuring the company attains its objectives.

CFO Responsibilities

The CFO, or chief financial officer, concentrates on the financial stewardship of the company and assumes a pivotal role in financial decision-making. Core responsibilities encompass:

- Financial stewardship: The CFO oversees the administration of the company’s financial assets, spanning accounting, budgeting, investment, and financing.

- Risk evaluation: Assessing and managing financial risks, from market volatility to indebtedness and asset management, is central to the CFO’s purview.

- Financial Planning: Crafting short and long-term financial strategies to guarantee financial stability and sustainable growth is a cornerstone of the CFO’s role.

- Financial Reporting: Producing precise financial reports and furnishing pertinent information to the board of directors, shareholders, and investors is paramount. Transparency and regulatory compliance are non-negotiable.

The CEO and CFO Relationship as a Strategic Partnership

While the CEO and CFO roles may appear distinct, they intertwine and complement each other in multifaceted ways. This relationship fundamentally epitomizes a strategic partnership in corporate governance, grounded in the synergy of their roles and responsibilities.

Strategic decisions serve as the compass guiding an organization, making the CEO-CFO partnership imperative, where vision converges with fiscal prudence, strategy aligns with financial efficacy, and decision-making is enriched by risk analysis.

- Clear objective delineation: The CEO sets the vision and strategic objectives, with the CFO translating these into tangible financial plans.

- Opportunity and risk evaluation: The CFO contributes financial acumen to assess the opportunities and risks entwined with strategic decisions, empowering the CEO’s decision-making.

- Performance metrics: The CFO furnishes crucial financial metrics aiding the CEO in gauging progress toward strategic goals and refining strategy when necessary.

CFO’s Strategic Decision Support

The CFO plays a pivotal role in fortifying the CEO’s strategic decision-making:

- Critical financial insights: Provision of current and accurate financial data empowers the CEO to comprehend the company’s financial health and its implications for strategic choices.

- Cost-benefit analysis: The CFO aids the CEO in evaluating the financial repercussions of diverse strategic alternatives, identifying costs, benefits, and associated risks.

- Long-term planning: Engaging in extensive financial planning allows the CEO to make sustainable and profitable long-term strategic decisions.

- Investment assessment: Facilitation of strategic project investment evaluations through comprehensive financial feasibility analysis.

- Financial risk management: Identification and mitigation of financial risks affecting strategy execution is the CFO’s domain.

Close collaboration between the CEO and CFO is imperative to underpin strategic decisions with robust financial analysis, harmonizing with the company’s objectives.

The Strategic Nexus between CEO and CFO

The CFO, spearheading financial management, collaborates closely with the CEO to ensure the financial vitality of the organization. Both leaders collaborate in pivotal decisions such as market expansions and mergers, navigating the intricate interplay between financial and strategic considerations. Effective communication is pivotal to ensure both are abreast of challenges and opportunities, achieved through regular meetings and open feedback.

Effective collaboration between the CEO and CFO is essential for business prosperity, harmonizing strategic vision with financial efficiency and fostering well-informed decisions that buttress long-term financial health.

Challenges and Resolutions

The CEO-CFO relationship encounters challenges, from divergent perspectives to communication lapses and pressures for immediate results.

To surmount these obstacles, sustaining open and consistent communication, fostering mutual comprehension of perspectives and priorities, defining clear goals and metrics reflecting both strategic and financial objectives, formulating joint financial plans supporting long-term health, and addressing conflicts constructively are indispensable.

These strategies cultivate effective collaboration between the CEO and CFO, contributing to the sustained success of the company.

Coordinated Commitment

Despite their specialized areas of focus, the triumph of the company hinges on the effective collaboration between CEO and CFO. They jointly bear the responsibility of ensuring the strategy is financially viable and aligns with the company’s objectives.

This shared responsibility fortifies decision-making and corporate governance, engendering a potent synergy that redounds to the benefit of the entire organization.

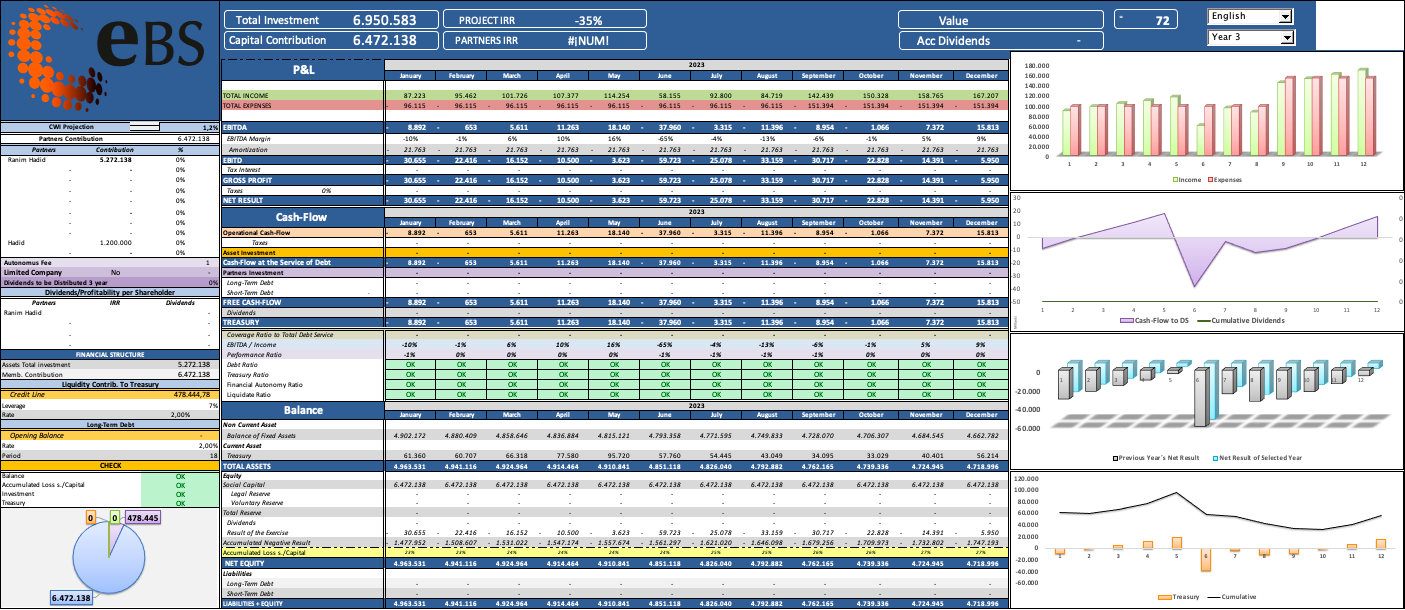

Encircle Business Solutions plays a pivotal role as a strategic partner for entrepreneurs, startups, and small to medium-sized enterprises (SMEs) in Qatar. By alleviating them of administrative and financial burdens, EBS enables these businesses to streamline their operations. With a keen understanding of individual projects, they customize their services to meet specific needs, constructing robust and tailored business models. Through seamless collaboration with CEOs and CFOs, EBS ensures meticulous financial control, empowering business owners to channel their energies into innovation and job creation.