In the dynamic landscape of business, startups face a myriad of challenges, and among the keys to their success lies a powerful tool that can be a true game-changer – financial modeling. Financial modeling is more than just a set of complex spreadsheets; it is the lifeline that guides startups through the tumultuous waters of decision-making, cash flow management, and strategic planning. This article explores why financial modeling is indispensable for startups and how it brings unparalleled value to their operations.

How can a financial model help us?

Strategic Decision Making:

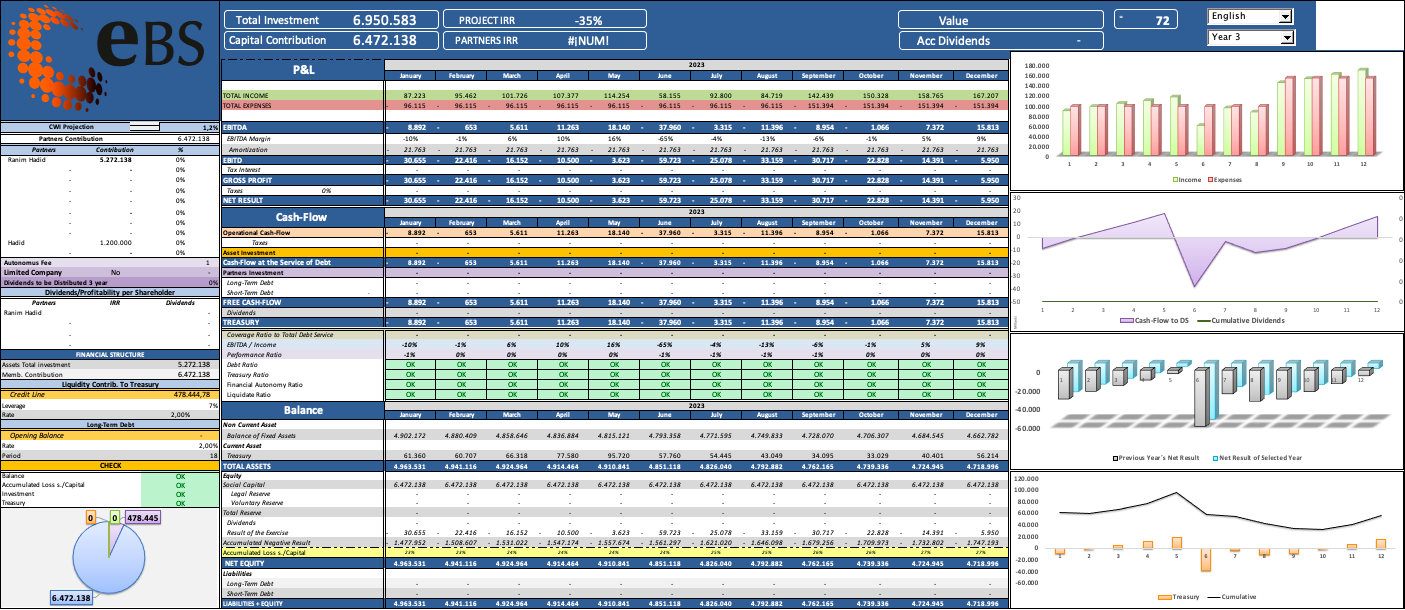

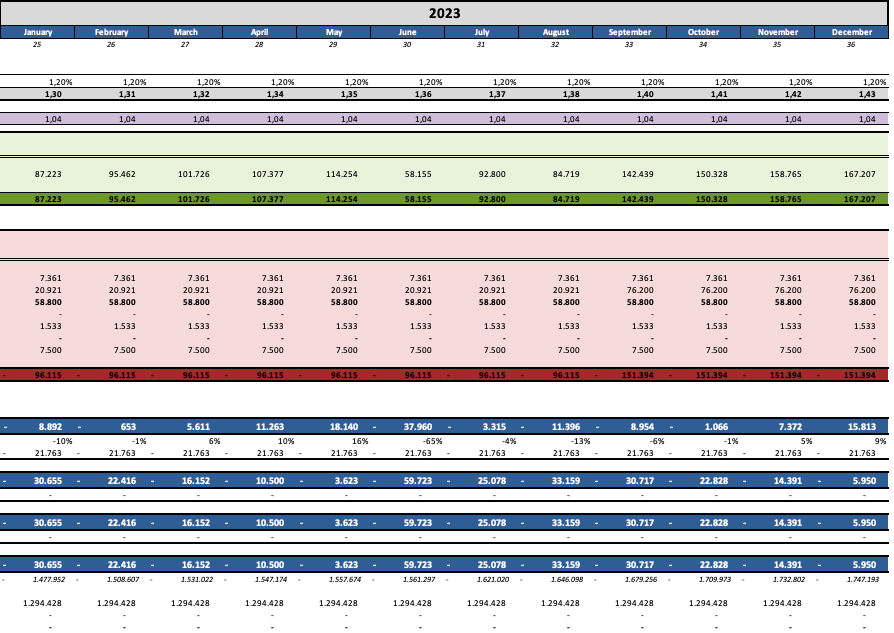

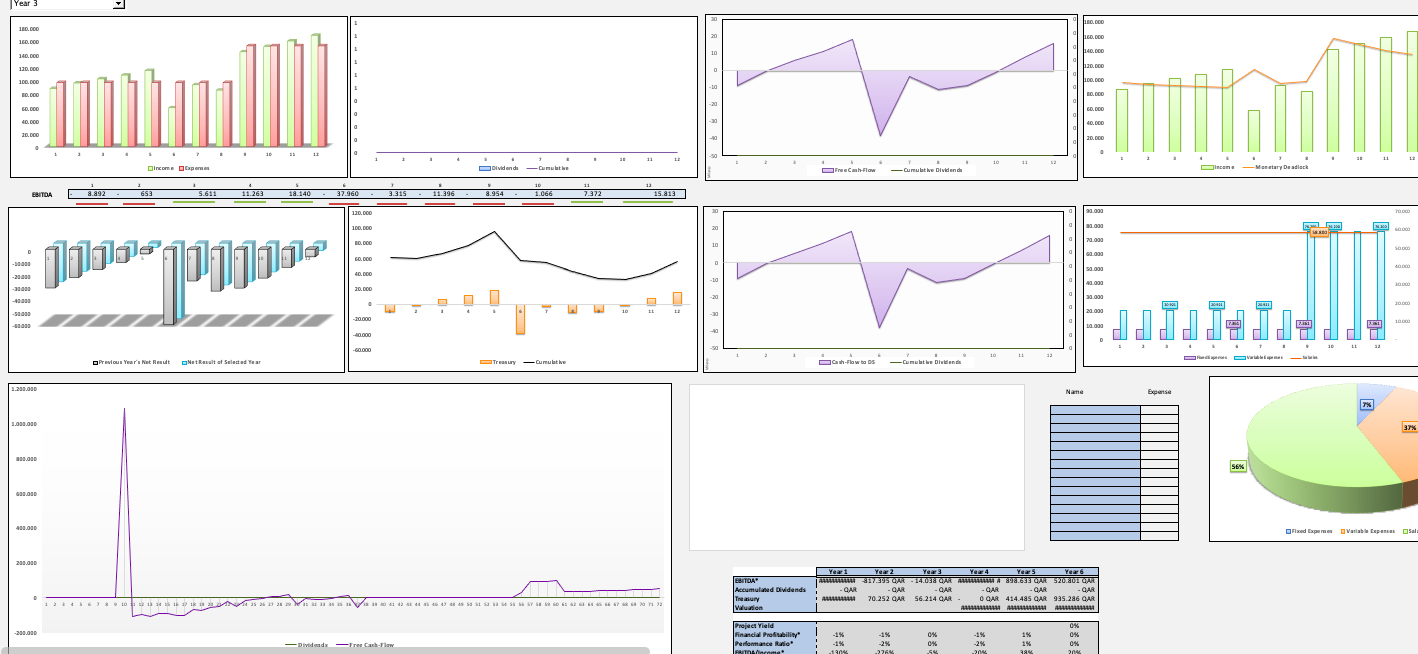

At the heart of every successful startup is a strategic vision, and financial modeling serves as the compass that guides decision-makers toward achieving that vision. By utilizing historical data, market trends and future projections, financial models empower executives to make informed decisions. Whether it’s assessing the feasibility of a new product launch, expanding into new markets, or securing funding, financial models provide a comprehensive view of the potential outcomes, allowing startups to navigate their path with confidence.

Cash Flow Control:

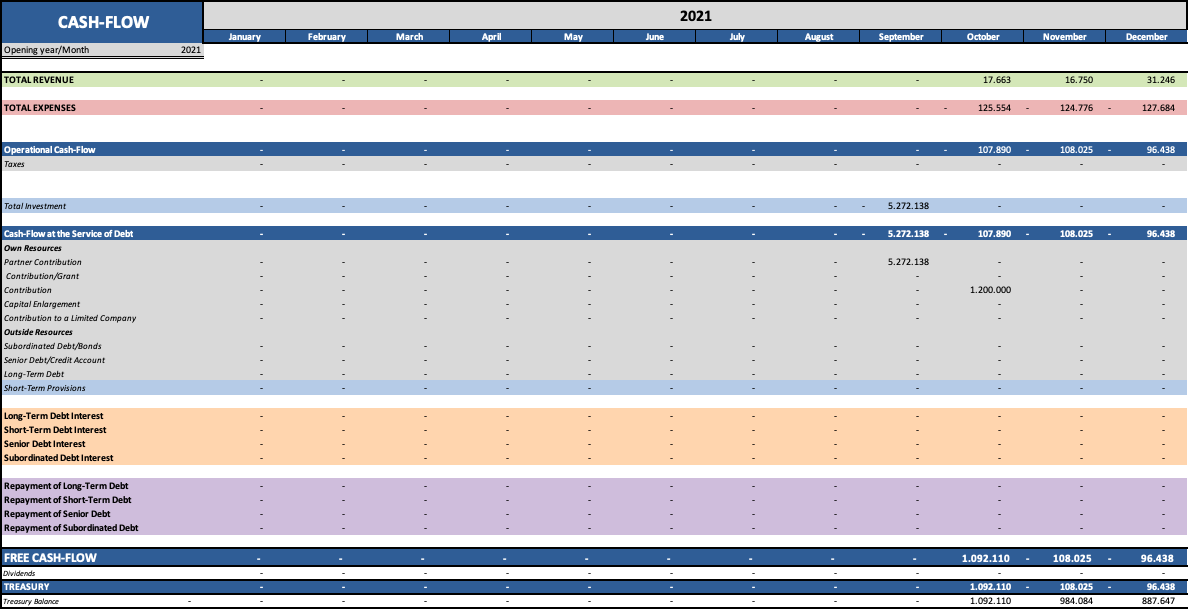

Cash flow is the lifeblood of any business, and startups, in particular, operate in an environment where cash reserves are often limited. Financial modeling enables CFOs and finance teams to meticulously forecast cash flows, ensuring that the company can meet its financial obligations, invest in growth opportunities, and weather unforeseen challenges. By forecasting cash flows, startups can avoid cash crunches, optimize working capital, and maintain financial stability even in the face of uncertainties.

Scenario Projection and Simulation:

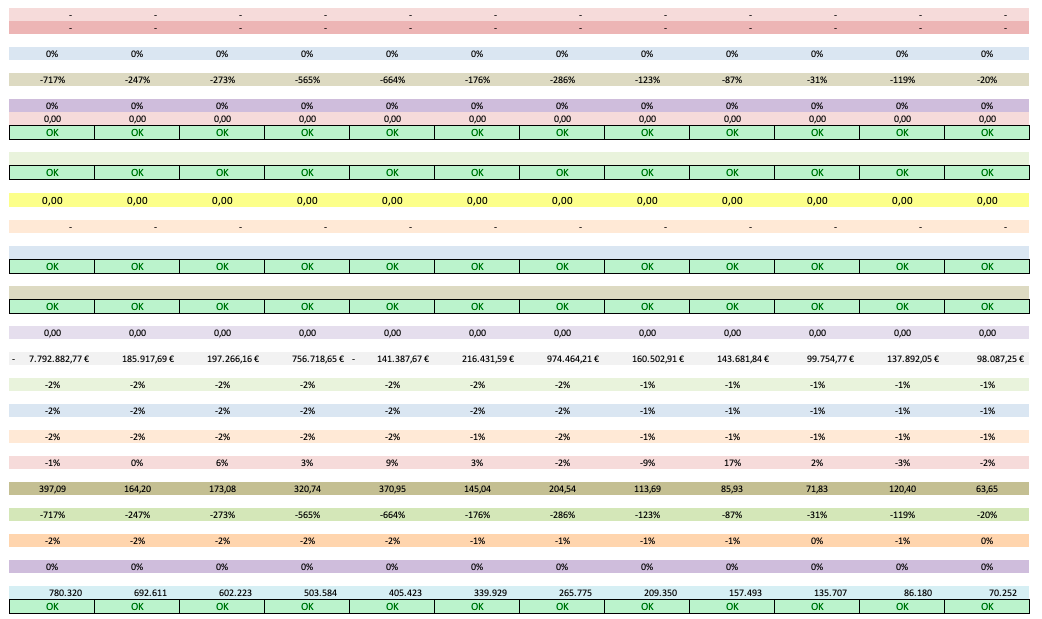

The business landscape is unpredictable, and startups need to be prepared for a range of scenarios. Financial modeling allows for the creation of scenario projections and simulations, offering insights into how different variables may impact the company’s financial health. Whether it’s changing market conditions, shifts in consumer behavior, or unexpected operational challenges, startups can proactively plan for various contingencies. This capability is particularly crucial for securing investor confidence, as it demonstrates a strategic and forward-thinking approach to risk management.

Investor Relations:

For startups seeking external funding, financial modeling is a fundamental tool in establishing credibility with potential investors. Accurate and well-constructed financial models showcase a thorough understanding of the business, its market, and the potential for returns on investment. CFOs can present a compelling case for funding by demonstrating a clear path to profitability, realistic growth projections, and a solid grasp of financial risk and mitigation strategies.

Operational Efficiency:

Financial modeling goes beyond strategic and financial planning; it contributes to operational efficiency. By analyzing key performance indicators (KPIs) and identifying areas for improvement, startups can streamline their operations, reduce costs, and enhance overall efficiency. This integrated approach aligns financial goals with operational objectives, ensuring that every aspect of the business works harmoniously toward sustainable growth.

The importance of financial modeling to optimize your startup

Financial modeling plays a pivotal role in overseeing day-to-day performance and progress, serving as a vital control tool for the management team. Its significance extends beyond routine monitoring, encompassing the generation of reports for both prospective and existing investors.

The purpose of financial modeling goes beyond forecasting a plausible future; it also involves retrospectively analyzing and reporting on the past. To build an effective financial model, one must consider not only future projections but also the key drivers influencing the business. While entrepreneurs must possess a comprehensive understanding of the numbers and may be involved in model editing, investors are the ultimate users of financial models and reports. Therefore, it is imperative that the model is characterized by simplicity, flexibility, accuracy, reliability and transparency.

Ensuring the use of robust financial models from the inception of a startup is crucial. At Encircle Business Solutions, we specialize in guiding, managing, and advising new startups on optimal strategies for growth and success. Given the myriad tasks involved in launching a new business, entrepreneurs often find themselves overwhelmed, potentially neglecting critical financial and administrative activities.

In the intricate dance of startup entrepreneurship, financial modeling emerges as a powerful partner, offering insights that can be the difference between success and failure. As CFOs increasingly rely on financial modeling to guide their organizations, startups equipped with robust financial models gain a competitive edge. From strategic decision-making to investor relations, cash flow control, and operational efficiency, financial modeling is not just a tool; it is the key to unlocking the full potential of a startup on its journey to success. As startups embrace the transformative power of financial modeling, they not only survive but thrive in the complex and ever-evolving business landscape.

How EBS brings value?

Based on the insights shared in this blog, establishing robust financial modeling is highly critical. At Encircle Business Solutions, our extensive expertise lies in seamlessly assisting numerous startups in constructing foolproof financial reports, systems, and calculation tabs. Our objective is to provide a fail-safe service that enhances the business’s success and elevates its outcomes.

We collaborate closely with our clients, aiming for synergy to achieve optimal results. Whether it involves handling reporting, developing financial models, analyzing key performance indicators (KPIs), guiding entrepreneurs in presenting compelling financial information to investors, or actively supporting entrepreneurs in networking and exploring potential markets, our partnership is geared towards excellence.